|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

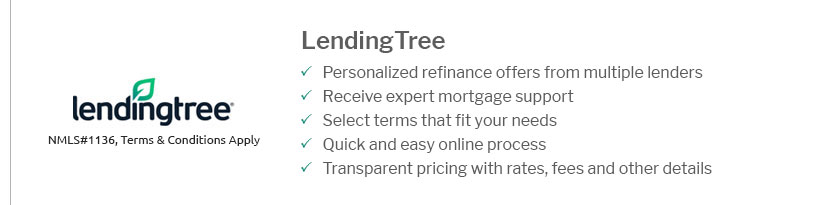

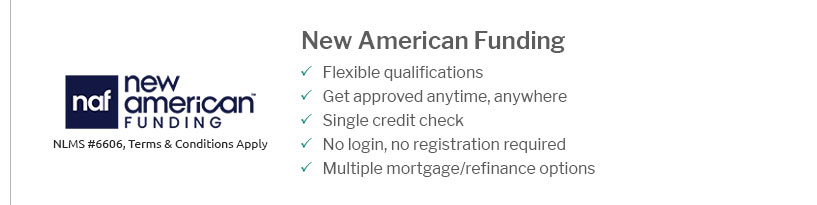

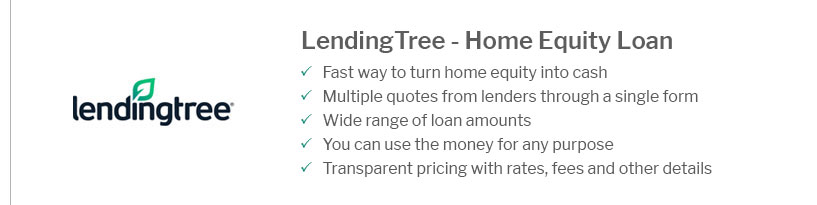

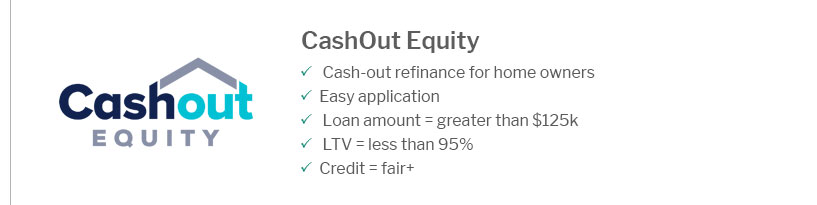

Understanding Who Does Mortgage Loans and Their Key RolesTypes of Mortgage Loan ProvidersWhen it comes to securing a mortgage, there are various types of lenders that potential homeowners can consider. Each has its own advantages and may cater to different needs. Banks and Credit UnionsBanks and credit unions are traditional sources for mortgage loans. They often offer competitive rates and the security of a well-established institution. Many people prefer them for their reputation and range of financial products. Mortgage BrokersMortgage brokers act as intermediaries between borrowers and lenders. They have access to multiple loan products and can help find the best fit for your financial situation. Brokers are particularly useful for those looking for a tailored approach. Online Mortgage LendersWith the rise of technology, online mortgage lenders have become increasingly popular. They provide convenience and often faster processing times. By leveraging technology, they can offer competitive rates and a seamless application process. Benefits of Online Lenders

For those interested in refinancing, exploring current refinance rates ca online can provide valuable insights. Specialized LendersSome lenders specialize in specific types of loans, such as FHA, VA, or USDA loans. These are designed to meet the needs of first-time buyers, veterans, or those purchasing in rural areas. Government-Backed Loan ProvidersThese lenders work in conjunction with government programs to offer loans with favorable terms. They are an excellent option for eligible borrowers who may not qualify for conventional loans. Choosing the Right LenderSelecting the right mortgage lender is crucial for a smooth home buying process. It's important to consider factors such as interest rates, loan terms, and customer service. Comparing Offers

Understanding the benefits of an equity finance loan can also help make an informed decision. Frequently Asked QuestionsWhat are the main types of mortgage lenders?The main types of mortgage lenders include banks, credit unions, mortgage brokers, and online lenders. Each offers different benefits, so it's important to assess your personal needs before deciding. How can I find the best mortgage rates?To find the best mortgage rates, it's recommended to compare offers from multiple lenders, including banks, credit unions, and online platforms. Checking online resources for current rates can also be beneficial. What should I consider when choosing a mortgage lender?Key factors to consider include interest rates, loan terms, lender reputation, and customer service. It's important to choose a lender that aligns with your financial goals and offers support throughout the loan process. https://fm.fanniemae.com/makerentcount/find-a-lender

*An NMLS number is assigned to mortgage lenders by the National Mortgage ... https://www.pnc.com/en/personal-banking/borrowing/home-lending/mortgage-loans.html

PNC offers a variety of standard & specialty mortgage loan products at competitive rates. Discover why PNC is rated the #1 Lender for Home Loans in 2024. https://www.wellsfargo.com/mortgage/learn/compare-mortgage-lenders/

Start with your bank. When you start your homebuying journey, talking with more than one lender can help you to determine the loan options and programs that ...

|

|---|